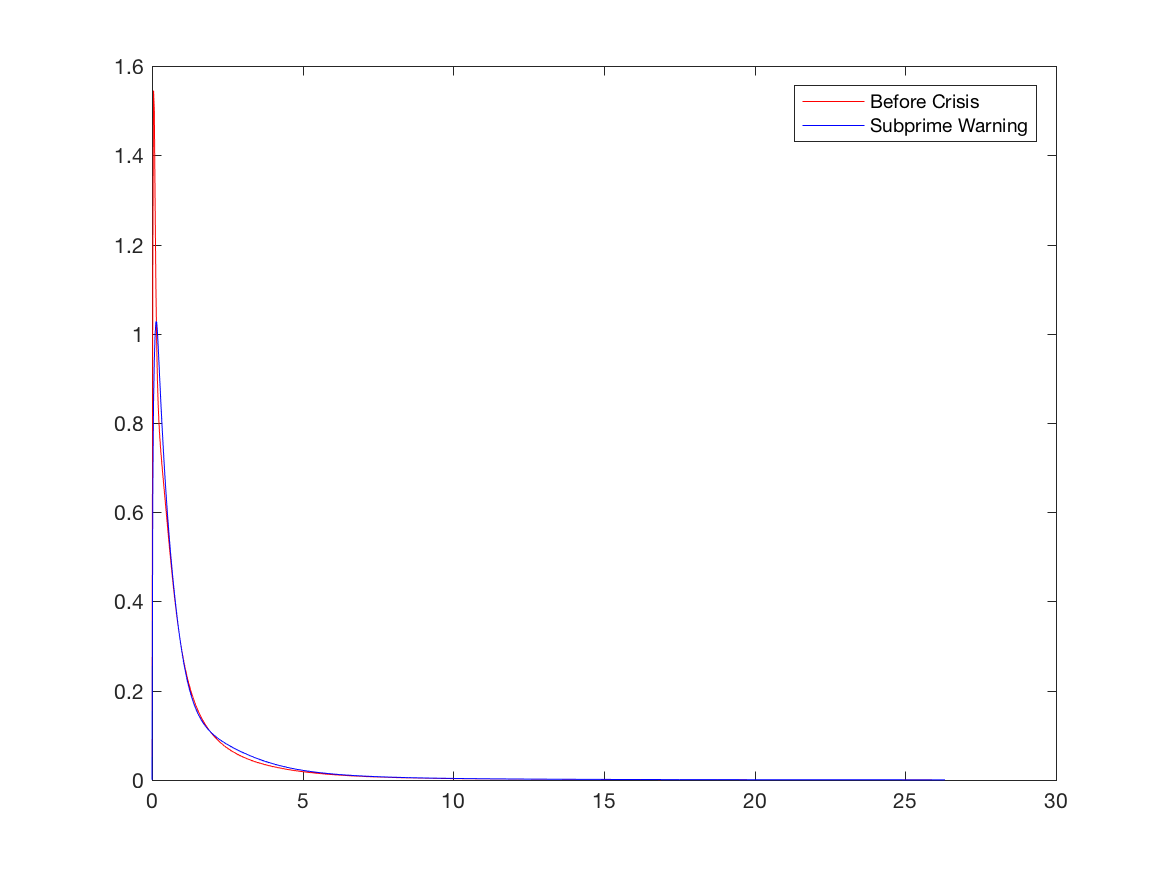

Comparison of Spillover Densities

This page allows you to compare selected frames from the animated spillover density

You can use the dropdown menus to select key events of interest

In each case, the spillover density on that day is compared to the spillover density before the financial crisis occurred

You can also choose to cumulate the spillover density if you wish

Before the financial crisis, most of the probability mass is close to zero, indicating a low probability of strong spillover effects

The spillover density moves right as the financial crisis unfolds, implying a higher probability of stronger spillover effects