|

|

| Recipient's sovereign risk response | Recipient's financial sector risk response |

Bailout Shocks

Select the source and recipient of the financial sector bailout shock below:

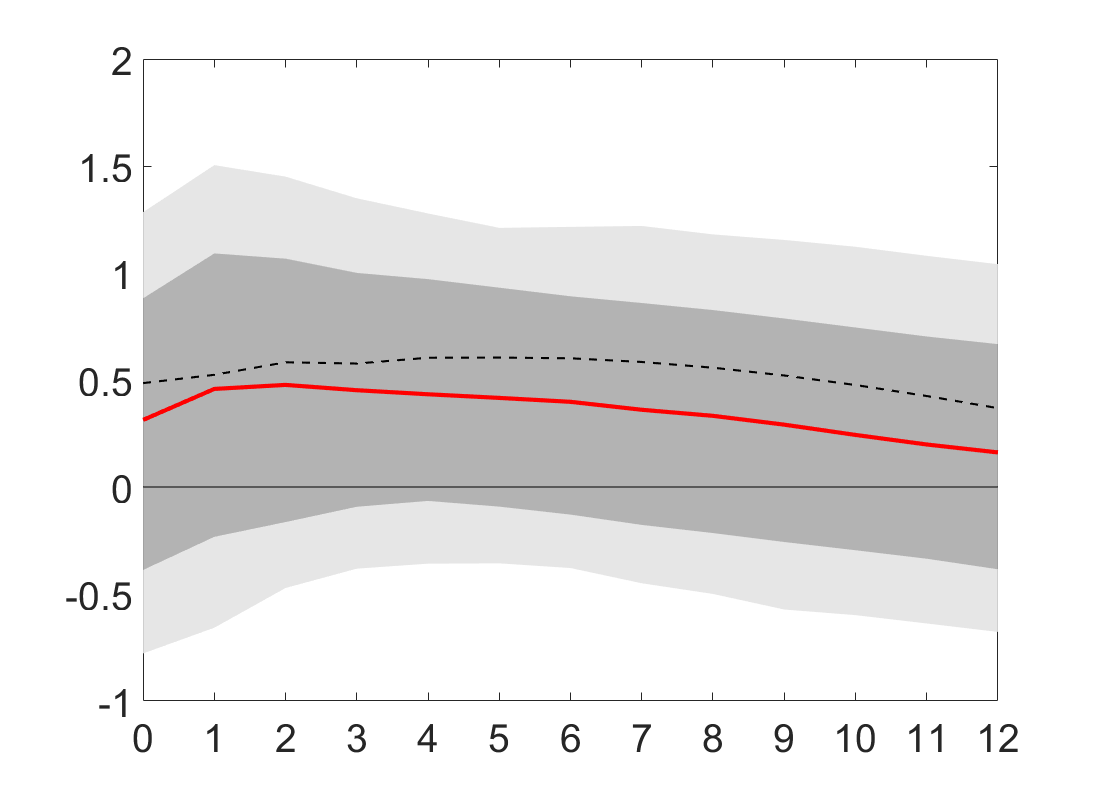

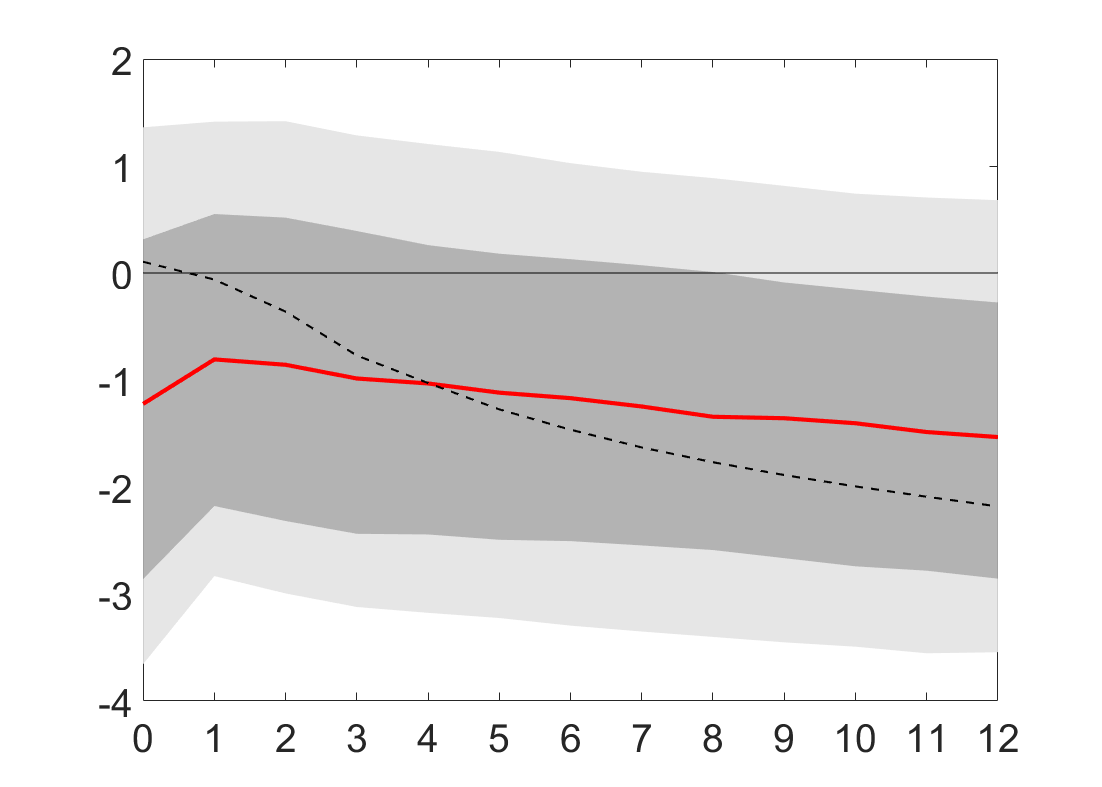

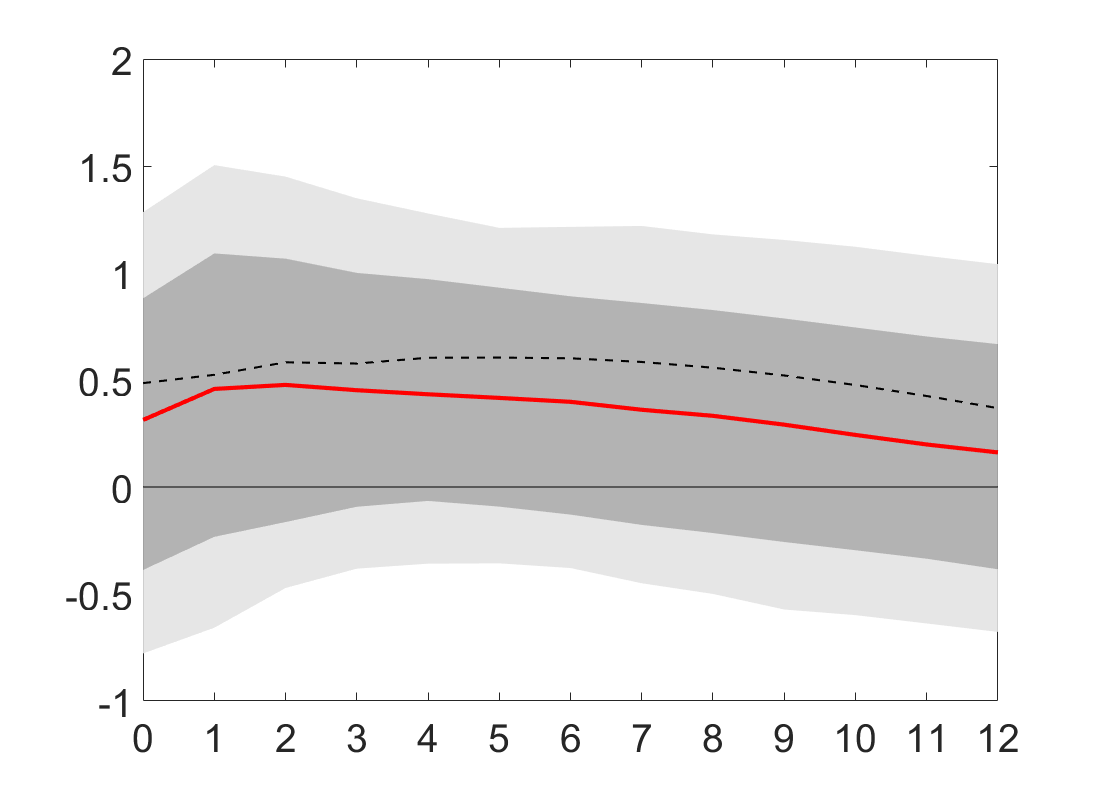

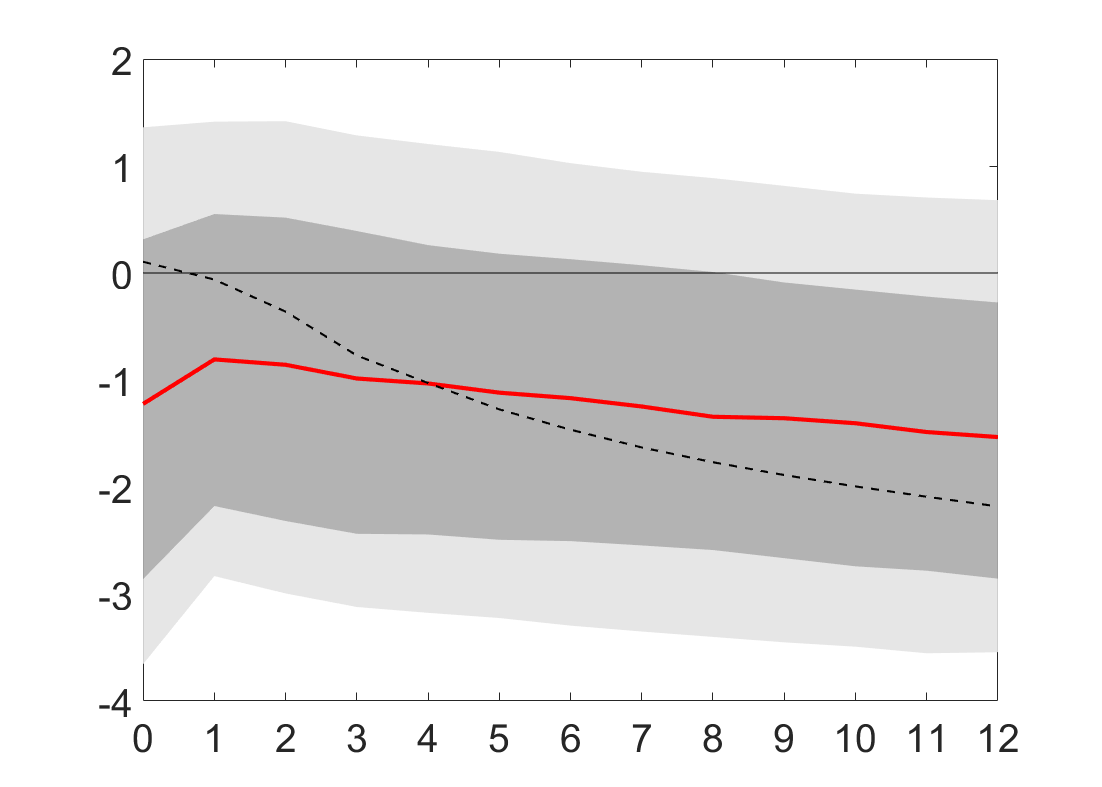

Two graphs are produced. The horizontal axes record the time horizon in weeks and the vertical axes measure the spillover effect in basis points

The red line shows the median impulse response, the black dashed line shows the median target impulse response and the dark and light gray bands report the 68% and 90% intervals (respectively) over the set of draws which are retained by the sign restrictions algorithm

The left panel shows the effect of the foreign bailout shock on the recipient's sovereign credit risk

The right panel shows the effect of the foreign bailout shock on financial sector credit risk in the recipient country

In the majority of cases, bailouts shocks do not generate substantial international spillovers onto either financial sector or sovereign credit risk

|

|

| Recipient's sovereign risk response | Recipient's financial sector risk response |