|

|

| Recipient's sovereign risk response | Recipient's financial sector risk response |

Sovereign Risk Shocks

Select the source and recipient of the sovereign risk shock below:

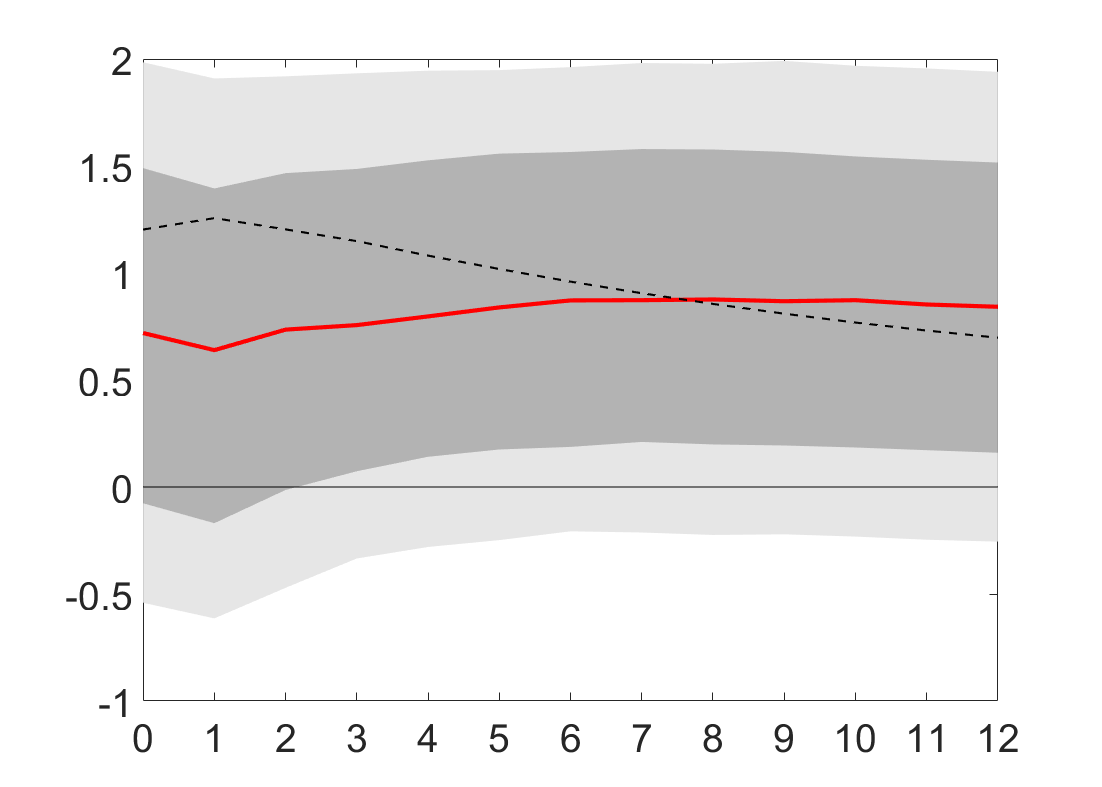

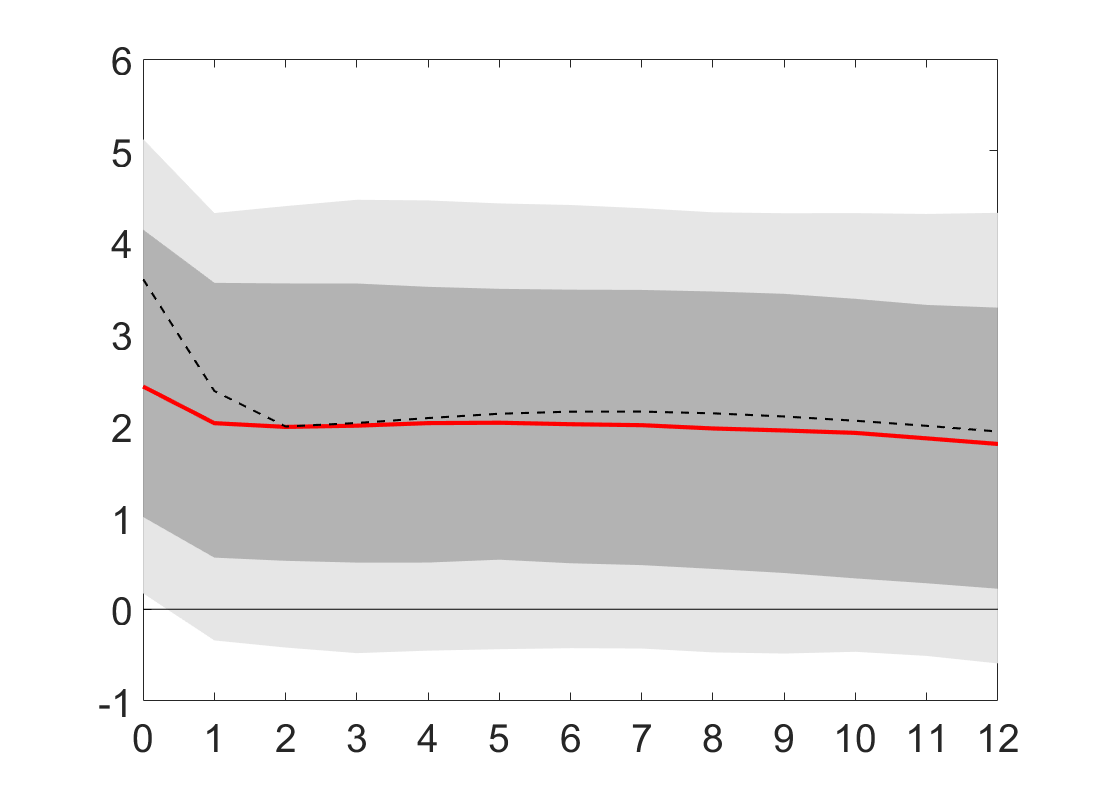

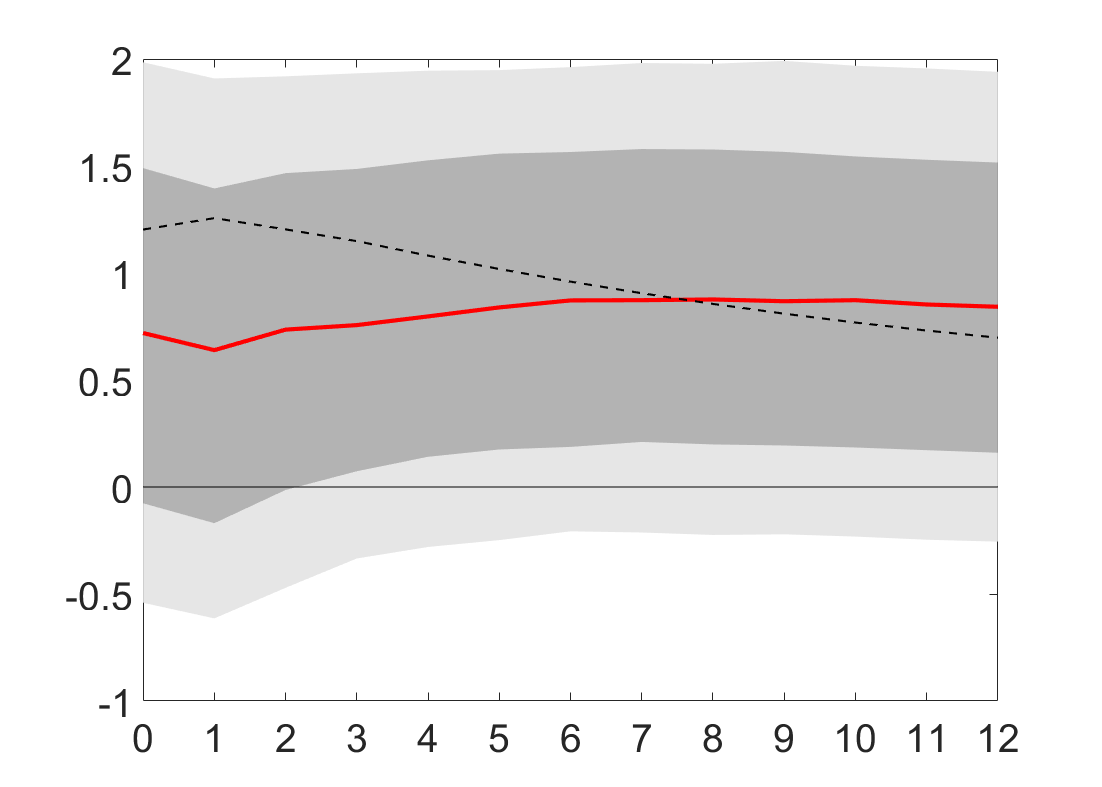

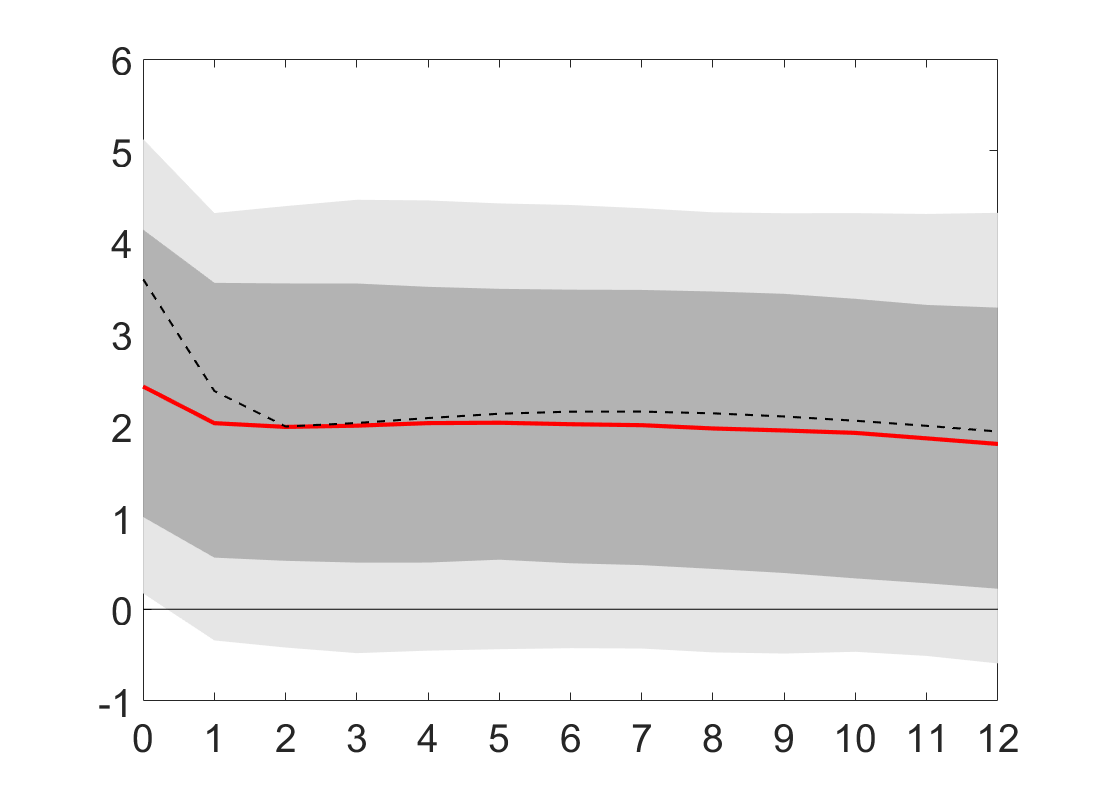

Two graphs are produced. The horizontal axes record the time horizon in weeks and the vertical axes measure the spillover effect in basis points

The red line shows the median impulse response, the black dashed line shows the median target impulse response and the dark and light gray bands report the 68% and 90% intervals (respectively) over the set of draws which are retained by the sign restrictions algorithm

The left panel shows the effect of the foreign sovereign risk shock on the recipient's sovereign credit risk

The right panel shows the effect of the foreign sovereign risk shock on financial sector credit risk in the recipient country

In most cases, both the receipient's sovereign and financial sector credit risk rise in response to a foreign sovereign risk shock. The response of financial sector credit risk is generally stronger than the response of sovereign risk.

|

|

| Recipient's sovereign risk response | Recipient's financial sector risk response |