Relative Tail-Dependence

Choose the relative tail-dependence (RTD) definition that you are interested in below:

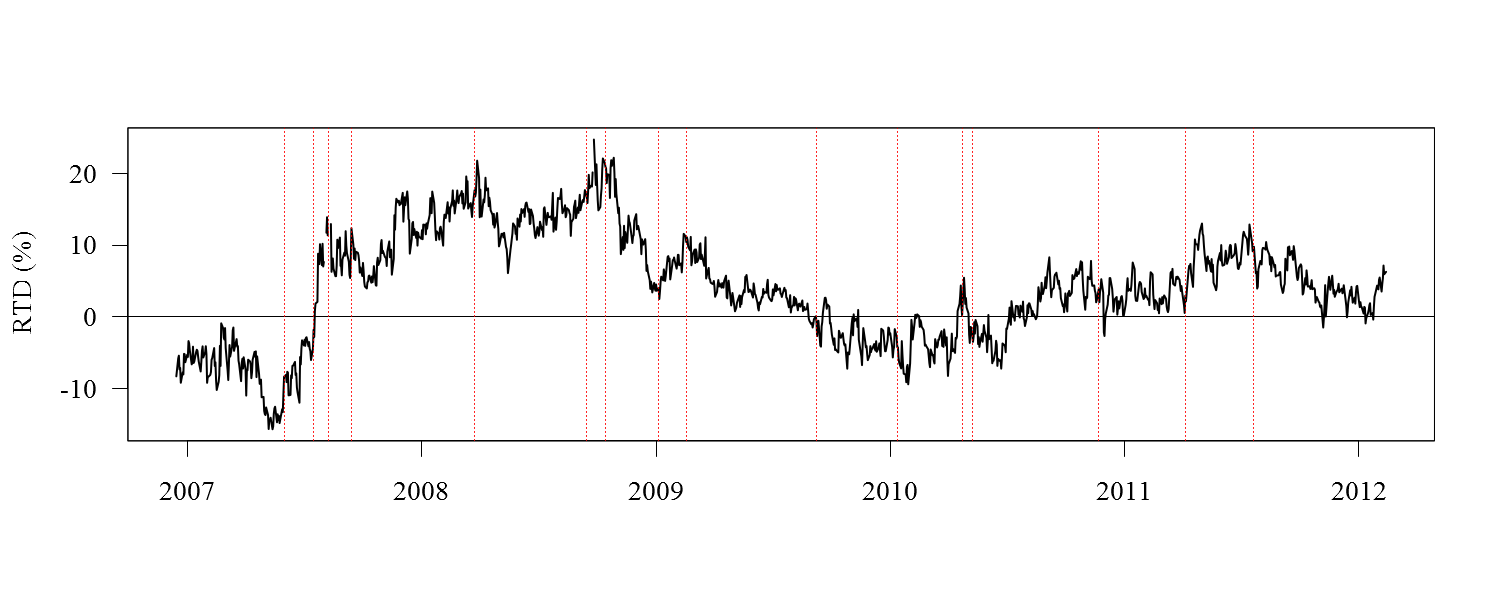

The q% RTD is defined as the difference between the spillover index at quantiles (1-q/100) and (q/100)

If RTD is positive (negative) then adverse shocks in the right tail of the conditional distribution propagate more (less) strongly than beneficial shocks in the left tail

Increases in RTD are destabilising -- sharp increases occur when adverse shocks happen (e.g. the revelation of losses at Bear Stearns funds in July 2007)

Reductions in RTD stabilising -- marked falls occur when beneficial shocks happen (e.g. the announcement of TARP in October 2008)